File your income tax return (ITR) for AY 2024-2025. FILE NOW

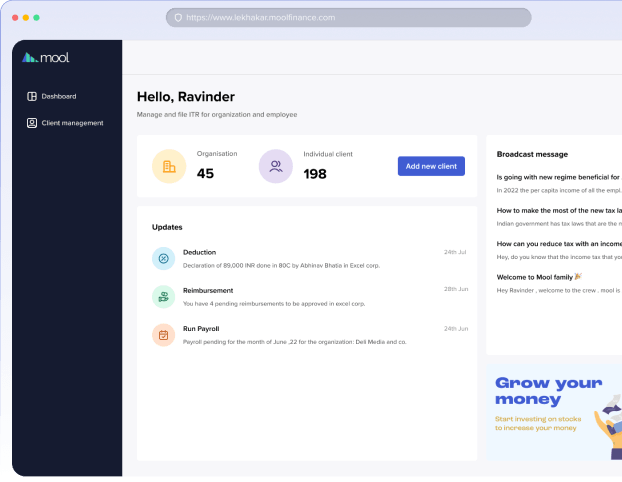

Client Management

Made Easy! with Mool Lekhakaar

Perfect for tax professionals managing multiple clients and enterprises through a single interface.

- Seamlessly Manage Payroll and IT Returns for your clients

- Save more than 90% time in operational tasks

- Automate compliances

Flexible SaaS Based Tool

Mool Lekhakaar provides flexible & seamless

cloud based workflow to automate your

client management process.

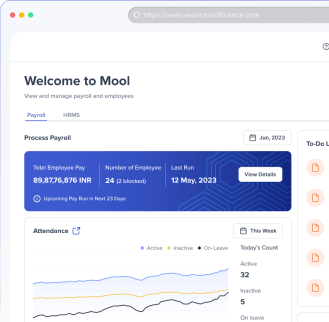

Build effective payroll operations

With Mool, your time spent on payroll operations reduces significantly. Focus on growth, leave the payroll operations to Mool.

Manual Payroll Process

- Gather Paperworks

- Select Employee for Payroll

- Check/Update All paperwork

- Run Payroll

- Freeze Payroll

5+ Days

Payroll Processing Time

Mool Payroll Process

- Select Employee for Payroll

- Run Payroll

- Freeze Payroll

Max 30 Mins

Payroll Processing Time

4d 23h 30m Time Saved

Client Speak

Easily integrate with your systems

Mool's seamless API Sandbox solution offers an efficient means to expand your employee management operations without the overhead of re-engineering your existing systems. Integrate with your existing HRMS, ERP or other employee systems with multiple options to choose from.

- Learning Management

- Rewards and Recognition

- Cards/Expense Management

- Corporate Travel Management

- Group health insurance

- Tax declarations

- ITR Filing support

- Payroll management

- Leave and attendance

Frequently Asked Questions

Have questions? Find answers here or contact us.

How is Mool Vetan different from other Payroll softwares ?

Mool Vetan is the only solution that offers personalized salary structures for employees, on top of everything else that most payroll software are offering presently. Mool's Personalization Engine is at the heart of everything that Mool Vetan delivers. Be it maximizing savings, take-home salary, or other employee benefits.

What is Mool's salary personalization?

Mool’s salary personalization is a unique feature that takes inputs from the employees about their spending and generates a tax-optimized structure best suited for that particular individual.

Does Mool Vetan generate compliance reports?

Yes! Mool generates state-wise compliance reports after the payroll is processed. In fact, Mool Vetan compliance audit feature is up-to-date with the Wages Act and Labor Laws across India.

Are TDS calculation on Perquisites (Perks) available in Mool Vetan?

Yes! TDS calculations for perquisites are a part of Mool as per the Income Tax laws. We understand the importance of perquisites for an employee and employer.

Does Mool provide IT Return filing service ?

Yes, Mool offers assisted ITR ( Income Tax Return ) filing services for Individuals. A user can register with us and upload all the necessary documentation. With the help of our Tax Experts, your IT Returns are prepared and filed online.

When can I start filing IT Returns through Mool?

You can start filing your Income Tax Return through Mool anytime. Currently, the deadline for filing returns without penalty is over for FY 2022-23. However, you can register and create account with us for FY 2023-24. Soon, we will allow you to store your documents and investment proofs online and when the returns filing season opens up for AY 2024-25, you can start the filing process.

Where can I find step by step process of filing ITR ?

You can read through our blogs and articles where we have explained the step by step process of filing ITR online. Else, you can create an account with us and through an easy process and video guide, you can file your ITR. We also provide assisted ITR service. You can get in touch with us and with the help of a tax expert, we can help you file the IT Returns.

What other services and products does Mool offer?

Mool is a comprehensive SaaS platform offering personalized tax and financial planning solutions to individuals and enterprises. We provide various SaaS based services including Income Tax Filing and Tax & salary planning for individual taxpayers; Employee Payroll Automation, Salary Personalization and Compliance Audit for Enterprises and Client management platform for Tax Experts and finance professionals.

Get ready to start your journey with Mool

Try out the new way of managing your employees and payroll. Our clients have turned around their employee management within 6 weeks and have seen measurable results. Get in touch for a free demo.

Access exclusive content and expert tips by subscribing to our newsletter today!

Mool is a leading financial startup that aims to create a sustainable solution for corporate employees by facilitating effective tax planning, smart investments, insurance, and borrowing options. Mool simplifies the personal financial and taxation jargon and makes it accessible to all. With the products of Mool, organizations and employees can now maximize the value of their salaries without a hassle. Mool’s mission is to create a platform to educate everyone, optimize the growth of their money, and empower them with rich facts and proven analysis for decision making.