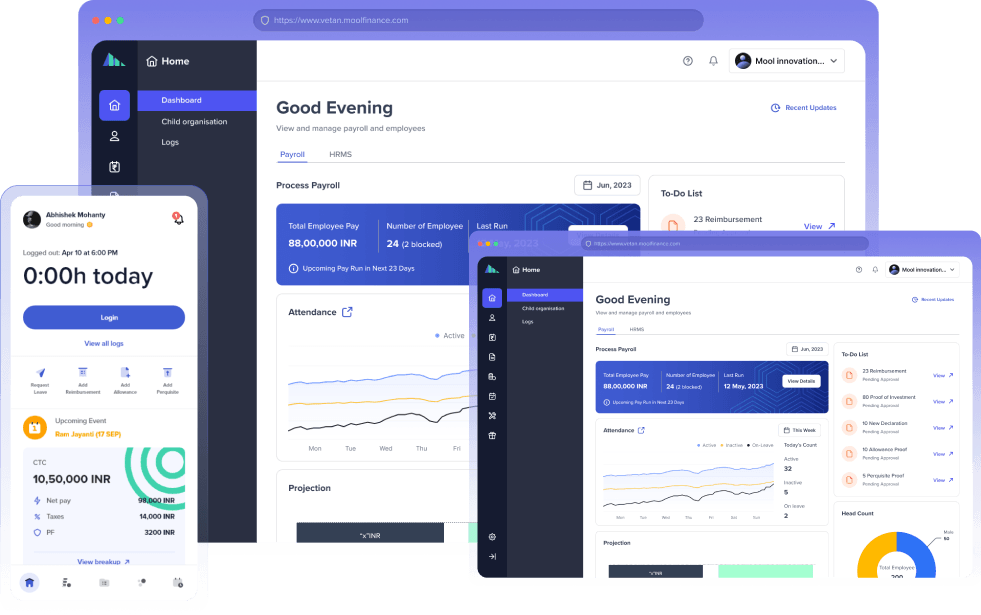

Mool Vetan

India's 1st Tax Optimization and Salary Personalization Solution

Salary personalization. Compensation design. Payroll automation. Compliance audit. Optimize operations and increase employee satisfaction & retention.

Our Trusted Network of Clients and Associates

Key Benefits

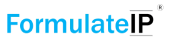

Mool is an intelligent solution that enables you to offer personalized compensation design for each employee, so they get the most of their salaries in hand. Empower your employees to maximize value from their salary based on their financial goals.

5 MD

Man days or more saved

100%

Compliant with tax and Labor Laws

0%

Manual effort

90%

Employees switch jobs for more in-hand salary

1000%

Accelerated growth

How mool works for you & your employees

Mool creates a win-win opportunity for employers and employees alike. Benefit from the intelligent automation solution that helps save tax for individual employees and saves costs for the employers.

For Employer

Efficiency, cost saving and happy employees

- Save money for your organization

- Transfer maximum value to your

employees at no additional cost - Increase employee satisfaction

- Boost Retention with employee-

friendly compensation policies - Accelerate Growth

For Employees

More value, tax planning support and empowerment

- More in-hand salaries

- Improved tax planning

- What if scenarios for choosing options

- Advantage of Tax-Optimized

Perquisites - Everything in one place

For Employees

More value, tax planning support and empowerment

- More in-hand salaries

- Improved tax planning

- What if scenarios for choosing options

- Advantage of Tax-Optimized

Perquisites - Everything in one place

Client Speak

Key Features

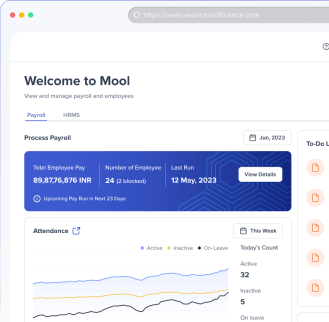

Trusted by professionals and enterprises alike, Mool is a renowned brand among enterprises, providing features and services that save time, effort and money.

How it works

Excited to see how Mool will implement Vetan in your organization? We got you covered.

Easily integrate with your systems

Mool's seamless API Sandbox solution offers an efficient means to expand your employee management operations without the overhead of re-engineering your existing systems. Integrate with your existing HRMS, ERP or other employee systems with multiple options to choose from.

- Learning Management

- Rewards and Recognition

- Cards/Expense Management

- Corporate Travel Management

- Group health insurance

- Tax declarations

- ITR Filing support

- Payroll management

- Leave and attendance

Mool for Everyone

Our solutions are designed to suit all types of enterprises. Compliant with industrial and labor laws across India, our solutions can be suitably configured to your requirements.

Startups

Costs you less than a cup of coffee per day. Easy to use, so you can focus on growth.

What you get:

- Employee Pay-out Management

- Leave & Attendance

- Salary Personalization

- CTC Calculator

- Employee Onboarding

SMEs

Hassle free labor law compliance and salary disbursement. Reduce operational overhead.

What you get:

- All features of Startup package

- Compliance audit

- TDS computation and filing

- All tax planning calculators

- Employee onboarding

Enterprises

Custom solution for enterprises focused on employee retention & salary personalization.

What you get:

- All features of SME package

- Dedicated account manager

- Personalized compensation design

- Self ITR filing for employees

- Employee onboarding

Get ready to start your journey with Mool

Try out the new way of managing your employees and payroll. Our clients have turned around their employee management within 6 weeks and have seen measurable results. Get in touch for a free demo.

Frequently Asked Questions

Have questions? Find answers here or contact us.

How is Mool Vetan different from other Payroll softwares ?

Mool Vetan is the only solution that offers personalized salary structures for employees, on top of everything else that most payroll software are offering presently. Mool's Personalization Engine is at the heart of everything that Mool Vetan delivers. Be it maximizing savings, take-home salary, or other employee benefits.

What is Mool's salary personalization?

Mool’s salary personalization is a unique feature that takes inputs from the employees about their spending and generates a tax-optimized structure best suited for that particular individual.

Does Mool Vetan generate compliance reports?

Yes! Mool generates state-wise compliance reports after the payroll is processed. In fact, Mool Vetan compliance audit feature is up-to-date with the Wages Act and Labor Laws across India.

Are TDS calculation on Perquisites (Perks) available in Mool Vetan?

Yes! TDS calculations for perquisites are a part of Mool as per the Income Tax laws. We understand the importance of perquisites for an employee and employer.

Does Mool provide IT Return filing service ?

Yes, Mool offers assisted ITR ( Income Tax Return ) filing services for Individuals. A user can register with us and upload all the necessary documentation. With the help of our Tax Experts, your IT Returns are prepared and filed online.

When can I start filing IT Returns through Mool?

You can start filing your Income Tax Return through Mool anytime. Currently, the deadline for filing returns without penalty is over for FY 2022-23. However, you can register and create account with us for FY 2023-24. Soon, we will allow you to store your documents and investment proofs online and when the returns filing season opens up for AY 2024-25, you can start the filing process.

Where can I find step by step process of filing ITR ?

You can read through our blogs and articles where we have explained the step by step process of filing ITR online. Else, you can create an account with us and through an easy process and video guide, you can file your ITR. We also provide assisted ITR service. You can get in touch with us and with the help of a tax expert, we can help you file the IT Returns.

What other services and products does Mool offer?

Mool is a comprehensive SaaS platform offering personalized tax and financial planning solutions to individuals and enterprises. We provide various SaaS based services including Income Tax Filing and Tax & salary planning for individual taxpayers; Employee Payroll Automation, Salary Personalization and Compliance Audit for Enterprises and Client management platform for Tax Experts and finance professionals.